Sales of Teslas are on a similar trajectory to sales of the Model T Ford following its launch in 1908. But can the growth continue?

Henry Ford changed the world — sort of. Ford himself was quick to credit others. He once said: "I invented nothing new. I simply assembled the discoveries of other men behind whom were centuries of work. Had I worked fifty or ten or even five years before, I would have failed. So it is with every new thing. Progress happens when all the factors that make for it are ready, and then it is inevitable. To teach that a comparatively few men are responsible for the greatest forward steps of mankind is the worst sort of nonsense."

He is also supposed to have said you can have any colour you like as long as it is black and supposedly created an economic revolution by increasing workers' pay so that competitors in the labour market were forced to increase pay, creating a consumption-led economic boom.

But the Model T Ford was also mass-produced, subject to assembly line production, which changed the world.

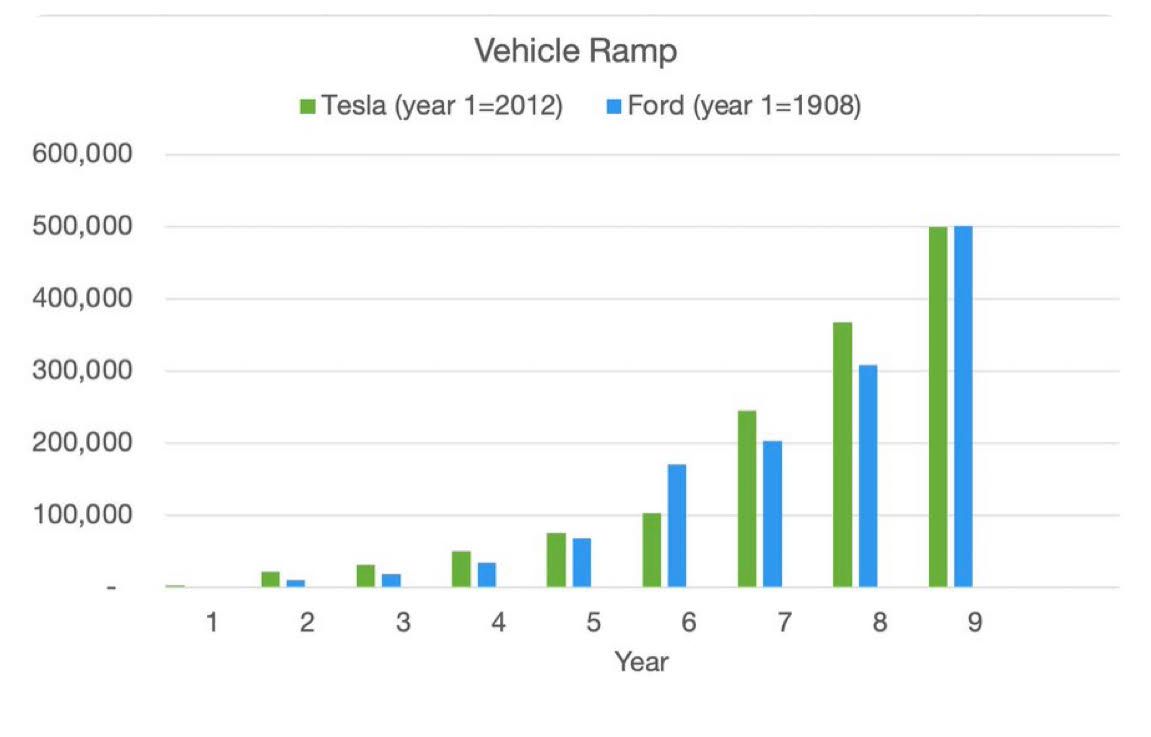

The car was launched in 1908. In year one, production was tiny; it wasn't until year six that annual production exceeded 100,000 vehicles, and year nine when it hit 500,000.

Compare this trajectory with the Tesla, courtesy of a Tweet from Sam Korus:

For everyone looking to compare the Tesla and Ford Model T ramp.

— Sam Korus (@skorusARK) July 26, 2021

Pulling data from Tesla website and Wikipedia for Ford. pic.twitter.com/qvH543F90E

So is the modern Tesla story really comparable to the story of the Model T Ford? Or will the apparent similarity be fleeting? After all, the big boys are in town; now, VW, GM, and Ford are all in the EV market.

Tesla's market cap

Let's compare market valuations

|

Market

cap in US$ billion |

|

|

Tesla |

621 |

|

Toyota |

$292 |

|

VW |

144 |

|

BYD |

96 |

|

Daimler |

93 |

|

GM |

80 |

In case you are interested, Ford is several places lower with a market cap of $54billion.

How can the Tesla market cap be justified?

VW made a profit of around $20b in 2019 and $11bn for 2020. Toyota's operating profit in 2020 was around $19 billion; GM made $6.4 billion. By contrast, Tesla made a profit of $721 million.

In 2020, Toyota sold 9.5 million cars, Tesla only sold 500,000 in 2020.

Tesla versus VW

Maybe Tesla's main rival in the EV market is VW, which has been drawing critical acclaim for its ID.3 and ID.4 models.

In the first half of 2032, VW delivered 170,939 EVs.

Tesla delivered 386,000 cars.

The growth for both Tesla and VW electric vehicles is extraordinary.

VW saw sales grow by 165 per cent, Tesla sales by 116 per cent.

So VW did see faster growth in EVs delivered, but from a lower base.

Tesla's advantage's over rivals

- Tesla applies a vertically integrated model — meaning it owns the majority of its supply chain. Theoretically, then its margin per car sale will be much higher than rivals — all else being equal

- Tesla specialises in batteries; it doesn't only make cars, but solar panels, its PowerWalls battery packs and grid-level back-up (in Australia). This gives Tesla potentially more scale and potentially more expertise in battery technology than rivals

- Tesla is as much a software and AI company as its rivals

- Elon Musk — entrepreneur extraordinaire

- Positioned for autonomous cars and car-sharing — a development that could do to the traditional car industry was the car did to the horse.

Tesla's disadvantage

- Less manufacturing infrastructure than rivals

- Inferior distribution networks to rivals — although there is nuance here; Tesla has a vertically integrated sales chain, so some might say this is advantageous

- Weaker management team

- Lower annual profits from which it can draw down to invest (on the other hand, its high market cap creates a superior opportunity to raise capital)

- Less well-known brand — globally

- Elon Musk, some say its talismanic boss, has become a liability

- Risky approach to autonomous cars — with some suggesting that it is testing its autonomous cars on the fly, in real-life, as opposed to a controlled environments.

Key point

But the key point relates to the impending development of car-sharing/autonomous cars, when we might see the emergence of the Transport as a Service model (TaaS). This model could be one of the most disruptive developments of all time — forget about the car disrupting the horse; this potential development could be up there with the invention of agriculture.

Tesla is better placed to capitalise on the TaaS market than any of its rivals. Perhaps this is it's real comparison to Ford and the Model-T, as long as it doesn't ruin its reputation through consumer based testing, a massive risk to it's future, especially if more people start to die as a result.

Related News

Tesla — has the bubble burst, or is it still a disruptor?

Jan 10, 2023

Unstructured data, super.AI and putting humans in the loop

Apr 21, 2022

ESG isn’t about ethics; it’s about profit — is that right?

Mar 30, 2022