Techopian's weekly roundup on some of the key stories covered this week. For those too busy during the week but need something to make them seem informed on Monday morning

'Taper' tantrum could be set to return

America tips the evolutionary scale - will AI be next?

Oil, exponential and the real dreamworld

Metaverse: really?

What happens when data gets into the wrong hands, like the Taliban.

3D printed Wagyu from stem cells

'Taper' tantrums could be set to return

Back in 2013, the then chair of the US Federal Reserve, Ben Bernanke, said that at some future date, the Fed would reduce bond purchases. That is all he said; that at some point in the future quantitative easing would be less of a thing. The technical definition of the Bernanke statement — one that only the highest brow publications ever use — is: 'the bleeding obvious.' His statement was about as shocking as a prediction from a weather forecaster that the sun might rise 'tomorrow.'

And the markets, the bond markets, in particular, reacted by throwing their dummies as far from their prams as they could possibly manage. They called it a 'taper tantrum', and the scare lasted all of a few weeks. If you want the above explained in less formal terms with less jargonistic words like bleeding and pram, then this account on Investopedia might do the trick.

Now, the 2021 Fed Chair, Jerome Powell, has hinted at the possibility of tapering quantitative easing. He said: "My view is that the 'substantial further progress' test has been met for inflation."

But he added: "Timing and pace of taper will not be intended to carry a direct signal regarding the timing of interest rate lift off."

In other words, to use more jargon, "don't worry, be happy," interest rates are not going up any time soon.

The shocking Powell announcement follows on from something that really is quite, well shocking is a bit strong, let's say "quite surprising."

Between March 23rd 2020, and August 16th 2021, the S&P 500 doubled. That was a gap of 354 trading days — the last time the index doubled that fast was, well, according to this piece, it's the fastest doubling since World War II. But it doesn't specify when in world War II, which isn't really surprising when you consider that the S&P 500 was launched in 1957.

Then again, data out at the end of July revealed that US GDP is now 0.8 per cent up on the pre-pandemic peak. This chart tells the story quite well:

The v-shaped recovery in the US is complete with Q2 real GDP hitting a new high, surpassing the prior high from Q4 2019. pic.twitter.com/q2tMwmXeFz

— Charlie Bilello (@charliebilello) August 26, 2021

So maybe we shouldn't be too surprised to learn that the S&P 500 has shaken off Covid woes. But what is a tad surprising is that the S&P 500 is now roughly 20 per cent up on the pre-pandemic high.

There are reasons for caution. For one thing, the latest Purchasing Managers Indexes suggest that the economic recovery in the US and UK slowed in August, although the EU did pretty well.

More alarming is the news that vaccine immunity to the Delta Variant could wane within three months.

And while some argue that it is imperative the West puts its booster programme on hold, freeing up vaccines for poorer nations, news on the virulence of Delta suggests that such suggestions will be ignored.

What we can say is that we need more vaccines — worldwide. The rollout so far has been a miracle of modern technology, but the miracle must persist.

That's not to say the above argument is a case against the vaccine. This chart makes it clear. In the US, States where vaccine rates are lower see higher Covid hospitalisations.

Covid-19 Hospitalization rates in the US: 9 out of the 10 highest states (and 18 out 20 highest) have full vaccination rates below the US average... pic.twitter.com/76xOxOoZev

— Charlie Bilello (@charliebilello) August 26, 2021

So the news on the economy is all a bit ambiguous (another technical description.) If Blackadder had been an economist, he might have said, "it is clear as mist at night time when you are wearing a blindfold." (We were going to say something a little ruder, but dash it all here it is; "as clear as a **** ***** ***** when it's cold." If you can work out what the asterisks stand for, then please let us know.

Something keeps getting forgotten. The cynics warn of doom — and there are things about the economy that are a tad scary. Other cynics pour derision on technology, talk about over-hyped tech , excessive-tech valuations and just, in general, say talk of a fourth industrial revolution is all: "bu*****t."

But here is a thought. Suppose Covid had happened in 1990. Or the year 2000. Or even 2010. What then? If Covid had emerged in 2017, would vaccines have been developed so quickly? Would it have been possible for a business to operate with its workforce working remotely?

The fact that Covid hasn't resulted in more deaths and caused much bigger economic upheaval is down to technology. We can play a game; how far must we go back to find the point when the economic impact and human casualties from Covid would have been much higher? Our guess is 'about three years.' Think of it in those terms, then doesn't that prove technology has had a massive impact, and maybe technology investors who are pumping up the value of stocks are cognisant of this.

Sure, stocks may crash — but they will recover. If you want an example of a real bubble, look at house prices instead — now there's a Ponzi scheme to make Bitcoin seem like the shrewdest investment since a young JD Rockefeller said: "ummm, oil looks like an interesting investment."

America tips the evolutionary scale - will AI be next?

More Americans now believe in evolution than don't.

The problem with evolution is that it is both an incredibly important concept, maybe the most important concept we have grasped in the last 200 hundred years, however, we still don't really grasp it.

Suppose that the principle of evolution was applied in a digital setting? Suppose we let AI algorithms evolve. What then?

Here is our piece on evolution, the myths of evolution, and its implications.

What we can say is the true implications of evolution, whether applied to digital or not, are as profound as you can get.

Oil, exponential and the real dreamworld

Revolutions are not gradual things — they wouldn't be revolutions if they were. The causes of the French Revolution might have been long in the making, but the French didn't storm the Bastille gradually. On the July 13th 1789, they didn't say, "we will have 100 per cent net stormed the Bastille by 1820."

Sir Ian Wood, an oil industry veteran, has called plans to stop drilling for oil in the North Sea "crazy." He said: "If we don't have our own oil and gas, we'll have to import it because we just don't have any other resources.

"And if we import it, we'll have more potent gas, and we'll do more damage to the environment - it would be, frankly, absolutely crazy. It would be detrimental, environmentally."

And he is right, assuming that is if we lived in a parallel dimension. In this parallel dimension, technology changes at a linear rate and we have got plenty of time to worry about climate change.

Unfortunately for Sir Ian's argument, we don't live in that dimension; and actually, the reason why Sir Ian is wrong lies with what is quite possibly the best piece of good news seen so far this century.

But then the cynics won't give up. A common approach applied by climate change deniers, delayers and the subset of this group, EV cynics, is cherry-picking data.

Take this article: "A growing body of research points to the likelihood that widespread replacement of conventional cars with EVs would likely have a relatively small impact on global emissions. And it's even possible that the outcome would increase emissions," says the author.

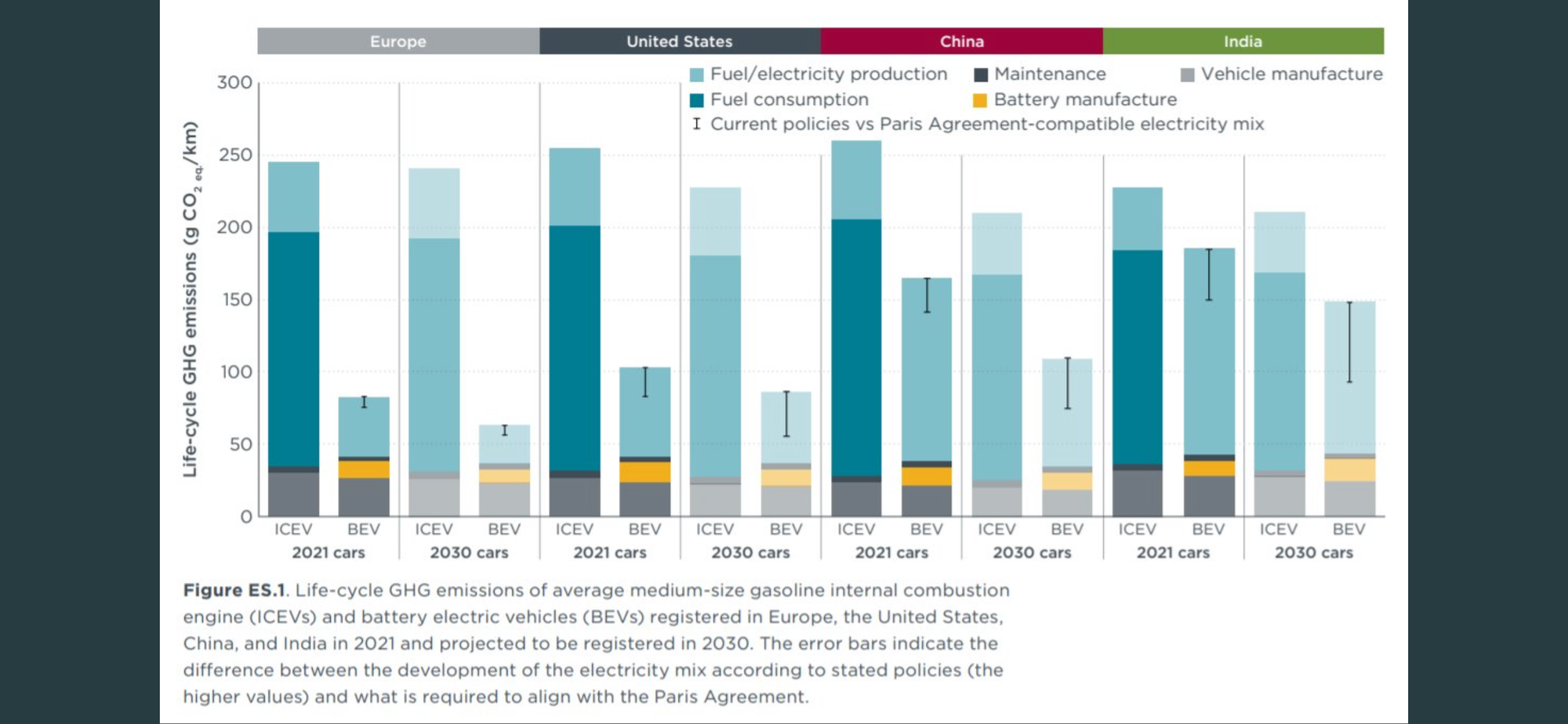

"A report from @TheICCT is used by the author to claim EVs only have a small CO2 emission advantage. Well, this is the key graph from the latest ICCT report on that. You decide" stated renewables guru Auke Hoekstra.

"When you compare the weight of gasoline vs batteries, at least take the 4x higher energy efficiency of the electric motor into account. (Sigh. Amateur.)," he Tweeted again.

This @TechCrunch article by @MarkPMills is a collage of anti-EV tropes, pasted together in a way that doesn't let facts interfere with the intended anti-EV story, written by an amateur firmly stuck in the fossil era and not open to contrary evidence. A hot mess indeed. https://t.co/lG34quachb

— AukeHoekstra (@AukeHoekstra) August 27, 2021

Metaverse: really?

Here's an idea to solve the problem of combining remote working and face to face communication— virtual reality. Mark Zuckerberg reckons the answer is the Metaverse as we all meet in virtual reality, communicate avatar to avatar.

Dear Mark, can my avatar make me look 30 years younger?

Here's our take: Augmented Reality:

"For example, you could have lunch with your partner, even if you are physically miles or even hundreds of miles apart. I foresee restaurant chains geared to augmented reality. The menu is identical in each restaurant; the furniture is identical — it will be as if you are together. Cameras will be placed, maybe green screens and AI will take a live feed of you and beam it over the ether to appear as a hologram. You will then appear in front of your partner; their hologram will appear in front of you. There just won't be any physical contact — no footsie under the table, for example. Or if your lunching doesn't have a romantic aspect to it, just friends meeting, there will be no handshaking or hugging. But hey, this will be the post-Covid world, and physical contact will be so very 2010s!"

What happens when data gets into the wrong hands, like the Taliban

Some data can be good, bad, and really bad if it gets into the wrong hands.

Let's take a random example — say the Taliban got hold of data pertaining to US sympathisers in Afghanistan.

Oh well, there is always encryption, and the Taliban is not exactly known for its army of de-crypters.

But here is the problem, and let's be cryptic; not every hacker in the world is on America's side.

A key part of data protection is what they call data minimisation — only keep the data you have to keep.

Maybe we should go a step further and say don't keep any data that could pose a threat to lives if it got into the wrong hands.

3D printed Wagyu from stem cells

Have you ever eaten Wagyu steak? It is delicious, apparently.

It is one of the most expensive meats in the world.

But now, researchers have managed to re-create it from stem cells.

"By improving this technology, it will be possible to not only reproduce complex meat structures, such as the beautiful sashi of Wagyu beef but to also make subtle adjustments to the fat and muscle components," senior author Michiya Matsusaki said.

Imagine that this kind of technology could follow a learning rate. For example, if the cost of lithium-ion batteries fell 97 per cent since 1991, imagine the implications should cultured meat fall at that rate all day.

Hope you enjoy the newsletter, let us know by emailing info@techopian.com and if you really like it, send it to a friend you really care about.

Related News

The AI revolution is here

Jan 25, 2023

The impossible conclusion about technology becoming less disruptive and why it is so dangerous

Jan 20, 2023

Tech bubble! Are you kidding?

Jan 06, 2023