Sustainability funds take a hit in the final quarter of 2022, but then again, investing in sustainable funds never was about quarterly thinking

There is more than one thing to unpick here. It turns out that 2022 was a good year for sustainable funds, but the final quarter was awful. And as is so often the case, onlookers pour their attention on the here and now as if it is becoming the trend when the underlying trend tells a different story.

The numbers are quite simple: sustainable US funds saw net $3 billion investment in 2022. But the final quarter saw a $6.2bn fall.

And it makes sense, it especially makes sense when you consider that the first quarter of 2022 saw $10.2bn in net receipts. Why does it make sense? Because the ESG hype machine was still ticking away at the beginning of last year. The words of people like Black Rock’s Larry Fink, with his pro-ESG comments, were still echoing in investors’ ears. Climate change fears were too obvious to be ignored. Labour shortages meant employers needed to find ways to keep staff happy. The post-Covid climate looked promising; companies needed an edge in selling to customers, and to many, ESG was that edge.

But then, with the war in Ukraine, a cost of living crisis dominated the headlines, consumers fretted over their escalating energy bills, investors wondered how high the oil price would go and then, to cap it all, the techs started laying off staff. The so-called knowledge workers who were suddenly out of work might have been tempted to ask: “labour shortages, what shortages?"

Morningstar revealed the data on sustainable funds, and two factors were held to blame for the Q4 exodus from sustainable funds: fears over greenwashing and the aggressively anti-sustainability or ESG moves coming from some legislators in certain US states.

In Kentucky, for example, state treasurer Allison Ball talked about withdrawing state pension funds from eleven firms, including Fink’s BlackRock, because they boycotted energy companies — a kind of game to see who had the bigger boycotting clout.

In Florida, Missouri and Texas, state finance officers, treasurers and comptrollers took turns to castigate BlackRock and other funds for their ESG emphasis.

So, actually, we have two different motives for the sustainable funds sell-off. First, there are the accusations of greenwashing, which to an extent, seem reasonable. Greenwashing is indeed a threat to ESG, and maybe it is time to see more emphasis on Impact Investing.

Then there is the “I don’t like ESG, I am not convinced about climate change, and it is time we stopped all this woke nonsense” mindset.

And smack bang in the middle of this is Elon Musk, fighting climate change with Tesla, trying to make humanity a multi-planetary species because we are so collectively stupid we might destroy this planet, whilst simultaneously apparently aligning himself with the anti-woke, and by extension, climate change denial, fraternity. You may love Musk, you may hate him; I am just confused by him.

Then Musk makes a shed load of redundancies at Twitter, the company doesn’t collapse, and those who can’t see beyond a quarter see this as proof that the laid-off ex-Twitter staff were superfluous to requirements.

But let’s do the opposite of quarterly thinking and try and think a few decades ahead, maybe to that time when Generation Alpha is beginning to take over from the ageing Generation Z, and the millennials are largely retired. It might be that by then, the world will resemble a post-apocalypse movie, but let’s assume things move on; that we are richer and, thanks to technological advances, live in something approaching abundance.

What will people think of the anti-woke, anti-net-zero mindset? Here is my prediction — one that I won’t live long enough to see either realised or quashed. I believe that the people of that time will look back at us with the same disbelief we hold for people who once believed in slavery, that women should earn less than men, that being gay was an abomination and that racial segregation was appropriate. If the world progresses, net zero will be as accepted as we accept the necessity of washing our hands or having a shower, and so-called woke issues will be as unthinking as the view that fascism is evil.

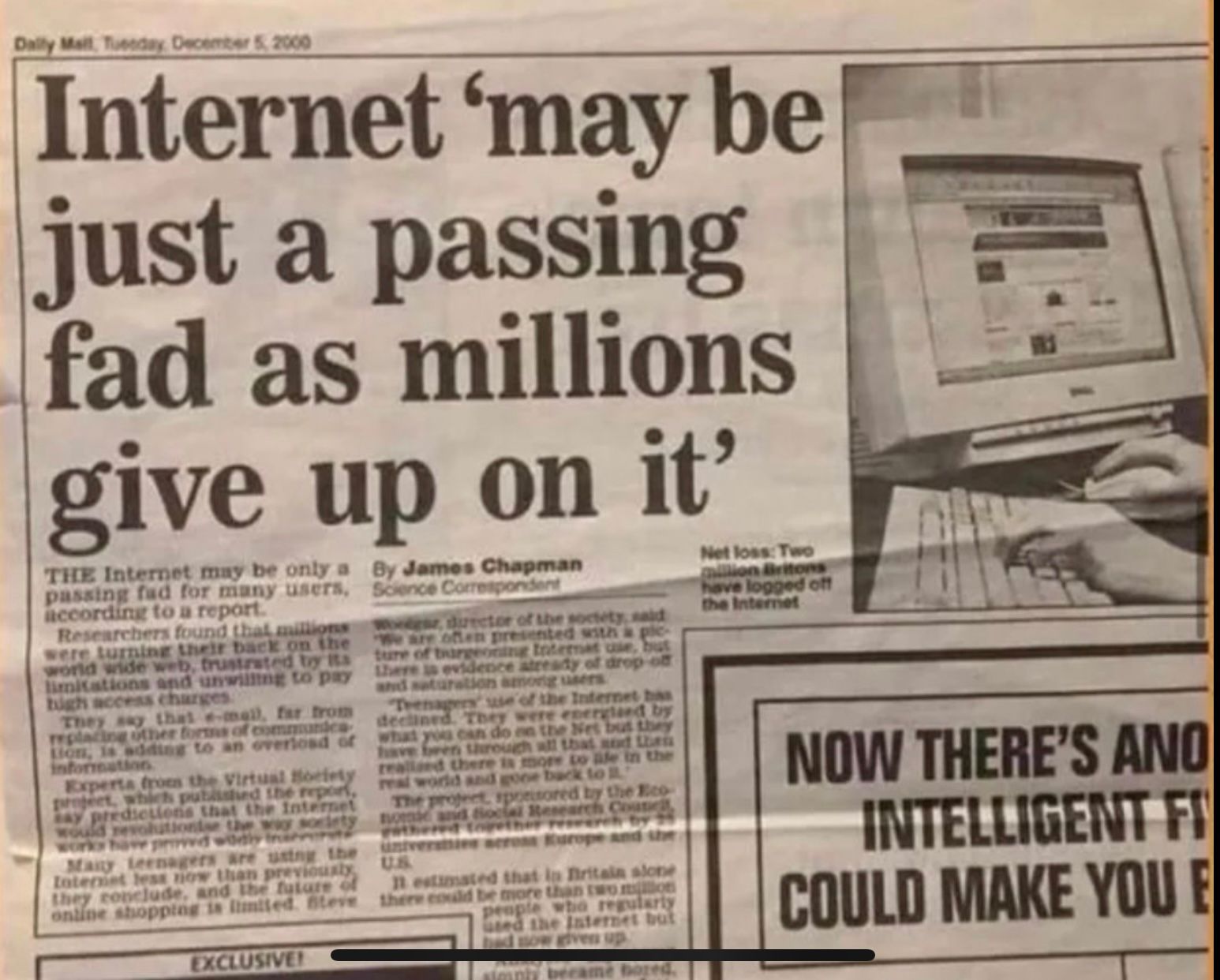

The ESG backlash of Q4 2022 will be an anomaly, like predictions in 2000 that the internet was a dying fad.

Because, actually, the economics of net-zero, of electric vehicles, of renewables, of sustainable practices, are so compelling that they are going to happen anyway. If the Ukrainian crisis has taught us anything, it is that reliance on oil diminishes our security.

As for so-called Wokeness, or to use its full meaning, awareness of social injustice, there are issues to be sorted out, but isn’t progress all about reducing social injustice?

And if instead of thinking a few decades ahead, we think a year or two ahead, labour shortages are not going away, demographic changes guarantee this. Social policies will become a necessity for companies trying to recruit and retain staff.

As for net zero, basic research reveals how it is winning; for example, in 2022, wind and solar became Europe’s top electricity source for the first time ever.

Auke Hoekstra has famously pointed out how the IEA keeps getting its forecasts for wind and solar growth wrong, consistently underestimating their growth rate. It may have something to do with solar and wind following an exponential like trajectory, whereas the IEA thinks linearly. In 2020, there was evidence the IEA was learning its lesson, and was finally factoring in the rapid solar growth. But in 2022, it got it spectacularly wrong again:

Solar is on a tear! pic.twitter.com/xz7Krq1BGQ

— Laurent Segalen (@MegaWattXinfo) February 14, 2023

According to popular mythology, Junius Morgan believed that electricity was a fad. His son, John Pierpont, or JP Morgan thought differently; the rest is history. Those who write off sustainability because of a poor quarter are likely to be as wrong as JP’s father was about electricity— although the industry probably could do with a shakeout.

Related News

Introducing The ESG Show Summit

Mar 05, 2025

Is AI really the solution?

Oct 25, 2024

ESG and the CEO

Jul 30, 2024