With vaccines being rolled-out on both sides of the Atlantic, with Covid infection and death rates falling rapidly, markets decide they don't like all this good news and sell. Shares in Apple and Amazon have been among the victims. Oddly, considering the negative press they have been getting, Facebook and Alphabet shares seem largely immune.

When democracy itself came under attack, the US markets roseIf the stock market were a person, it would like a Bond villain, stroking a cat, laughing at other's misfortune

There is a rule that sort of explains it; 'buy on rumour sell on news.' It could work just as well, the other way around, of course: 'sell on rumour, buy on news.' The idea behind this saying is the markets anticipate news, so by the time something happens, stock markets have already allowed for it. That's the theory; the reality sits somewhere in a range which at one end says 'reality is more nuanced,' and at the other extreme, one could use a word to describe it that also describes what male cows leave all over the grass.

What we can say is that while the Covid-19 virus and related lockdowns reaped havoc across the economy, US stock markets kept setting new records. Then, later, on the day of the riots on Capitol Hill, when democracy itself came under attack, the US markets rose further.

But this year has seen good news. The Covid death rate and infection rate is falling fast.

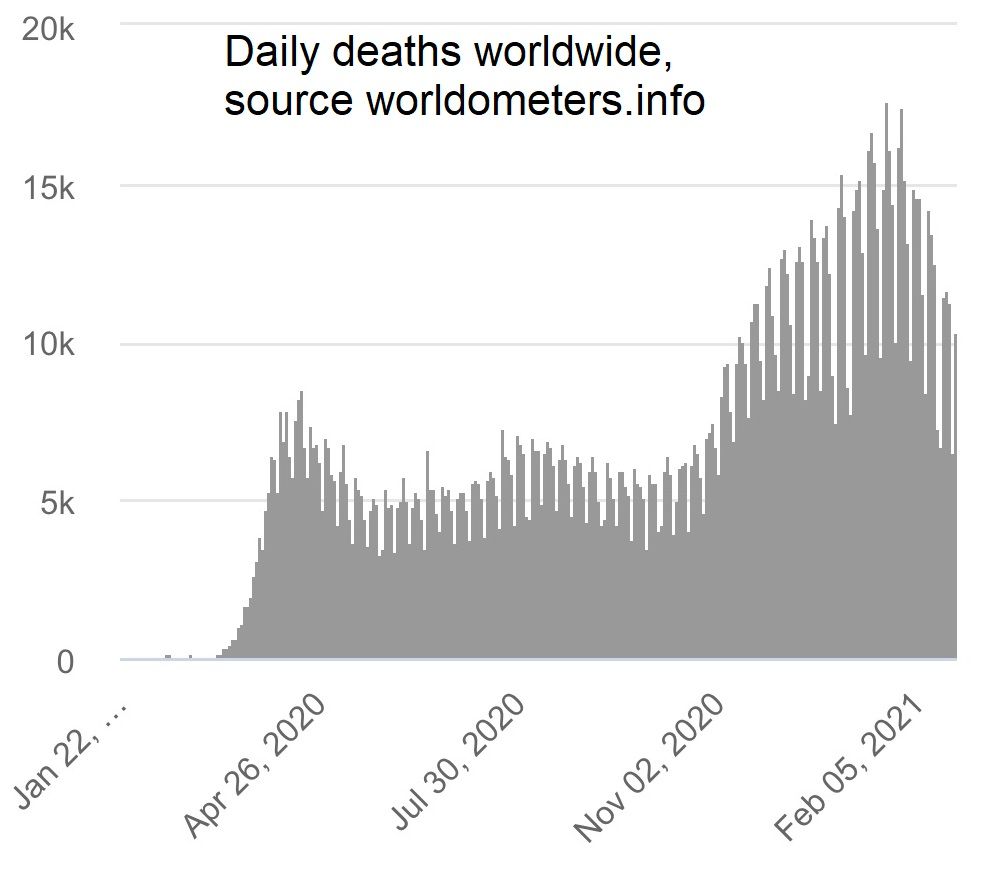

Take this chart taken from the worldometers site

The seven-day moving average tracking Covid fatalities worldwide has halved this year. In the US, the infection rate is a quarter of what it was at the beginning of January.

For the first time since news of this coronavirus broke at the beginning of last year, we have genuine, bona fide good news to report. And what do the markets do? Why, they go out and sell, of course

Meanwhile, the vaccine roll-out continues. In Israel, for every 100 people, on average, 87 people have been vaccinated. The average for the UK stands at 21 and 14 for the US. But expect those ratios in the UK and US and across most of the world to double within a few weeks.

For the first time since news of this coronavirus first broke at the beginning of last year, we have genuine, bona fide good news to report. And what do the markets do? Why, they go out and sell, of course.

Tesla has been the biggest loser — shares are down by almost a quarter since the share price peaked in January. Tesla's market cap is now a mere $670 billion — there are now no less than eight companies in the world worth more than Tesla. In the last few days, Facebook, Tencent and Alibaba have all leapfrogged Tesla in the league table charting the world's biggest companies.

Apple shares have fallen ten per cent in recent days. Amazon shares have fallen by a similar amount. You would have to rewind the clock all the way back to January 20th 2021, to find the last time Amazon shares were so cheap. You would have to go back even further to find the last time Apple shares were this low; not since the distant days of January 6th 2021, have they been this low. Or, to put it another way, shares have merely reversed some of the extraordinary rises seen in the last year — the Apple share price has doubled since March last year.

There is a sort of logic to the fall in the Apple and Amazon share price, after-all, both companies have benefited from lockdown, so they may lose out if lockdown ends, but it is too soon to call a tech crash. We may be at the early stages of a big sell-off. Only time will tell.

As for Tesla, it seems the main reason why its share price fell so far relates to its decision to buy $1.5 billion bitcoins.

Incidentally, the bitcoin price is currently 14 per cent off-peak — but then the recent fall merely reversed one week's worth of increases — it has fallen back to the level it was at on February 17th. (In case you are interested, bitcoin is up on the price Tesla paid for it.)

But the oddity relates to Facebook and Alphabet.

Alphabet shares are within two per cent — or spitting distance — of their all-time high, set last week. Facebook shares have lost even less — down by less than one per cent, which is inconsequential, given that shares go up and down all the time.

Tech companies forming government, should the giant tech's be broken up?

While Apple busily lectures Facebook on its ethical approach to data, and Facebook is accused of bullying the Australian government; while more people float the idea of a Google and Facebook tax to fund editorial content, and while others talk about breaking the two companies up, their share prices seem immune to the market sell-off.

Apple versus Facebook, the future of social media, isn't Clubhouse; it's immersive reality

Maybe, somewhere on some golden throne, Mr or Mrs Market is laughing manically while stroking their purring cat.

Related News

Liz's poisoned chalice and the hint of hope

Sep 06, 2022

Cut profits to pay workers: does it make sense?

Jul 05, 2022

Is rationing the solution to the cost of living crisis?

May 30, 2022