The death of neo-liberalism

Graphene set to pass tipping point

The battle of exponential will determine outcome of climate change war

The illusion of cycles

Investors are flying blind over ESG

Techopian's weekly roundup on some of the key stories covered this week. For those too busy during the week but need something to make them seem informed on Monday morning

Goodbye darkness and hello exponential my new friend

There is a theme to this weeks newsletter, and it’s exponential technologies. Exponential is changing everything.

The death of neo-liberalism

Sometimes we try too hard to apply the lessons of history. Churchill said, the “longer you can look back, the farther you can look forward.” But that is not always true.

Neoliberalism is dying. The lesson of history isn’t much good as we have never had neoliberalism before. The era that began with Thatcher and Reagan is experiencing its final hours.

Why is this different? For one thing, we have never lived in an era of exponential technologies before.

And that is good.

Graphene set to pass tipping point

Back in 2004, the wonder material graphene was first isolated — and we were told it would change the world, but so far, so very little.

But isn’t that how exponential works? You keep doubling a tiny number, and even after several doublings, the number remains tiny.

The cost of graphene has fallen 99.8 per cent since 2010. That means its cost has halved every year — or maybe every 13 months, we will leave you to do the precise maths. If that ain’t exponential, not sure what is.

The result of exponential is that graphene is beginning to become more common. For example, a new gym being built near Stonehenge will be built upon foundations reinforced with graphene, something called concretene. Graphene is passing a tipping point.

The battle of exponential will determine outcome of climate change war

A blood-curdling claim by a climate-change scientist suggests that global warming might be following an exponential rate.

Not even John Carpenter (director of the original Halloween movie) and Wes Craven (director of A Nightmare on Elm Street and the Scream franchise) can match that for terrifying.

But our new friend 'exponential' can save the day. See:

The battle of exponential will determine outcome of climate change war

The illusion of cycles

The following is obvious, and you smart reader would never fall for it, but it is amazing how often people do.

The years 1997-1998 were El Niño years. This means that global temperatures were pushed up a tad during this period, and the following few years were cooler in comparison. Climate change deniers seized upon this data, “temperatures are down on 1998,” they screamed, and joined fictitious dots together and concluded climate change was a scam. Of course, their argument fell apart. Cyclic events, such as El Niños, can temporarily disguise an underlying trend, but only for a short while.

Now we see another example — the cost of lithium-ion batteries might be set to increase, suggests Bloomberg. The renewable cynics will jump on the news: “See,” they will say triumphantly, “the renewables dream is over. Wake up and smell the diesel.” Actually, if we followed their advice, we wouldn’t even get the aroma of diesel, more like arsenic.

The increase in the raw materials costs may well disguise the trend for a short while. But, just as was the case with the El Niño and climate change, the underlying trend will overwhelm the cycle.

Except, and this is where the climate change analogy breaks down. The increase in raw materials costs is not really a cycle at all; these are one-off increases caused by the temporary effect of Covid.

Take the price of lumber and copper to illustrate the point.

Earlier this year, the inflationist excitedly announced that inflation was back. Why? Well, they pointed to the price of lumber and copper. Between December last year and May this year, the lumber price increased two and a half times over. The copper price surged too. It was alarming stuff. But look at the data now, and the lumber price is back to the level it was last December, and copper has fallen sharply too.

So yes, there will be no doubt be stories circulating that the lithium-ion fairy tale is over. But, of course, the exponential rate will fall eventually. Lithium-ion batteries and renewables will not live happily ever after together. But the doubters are like John Carpenter, scaring us with fiction.

Meanwhile, the inflationist behaves like Wes Craven; they scare us with tales about the return of darkness (or inflation) and say it is as if the 1970s are back. They look back at history and ask, “why are humans so incapable of learning the lesson of history?” Yet they themselves are guilty of that very thing. Inflation surged after the 2008 crash, before collapsing. Inflation also surged after World War 2, before plummeting.

The biggest risk is that we fail to learn the lesson of post World War 1, which in the UK saw inflation fool policymakers. It rapidly turned to deflation, and the UK experienced economic depression as a result.

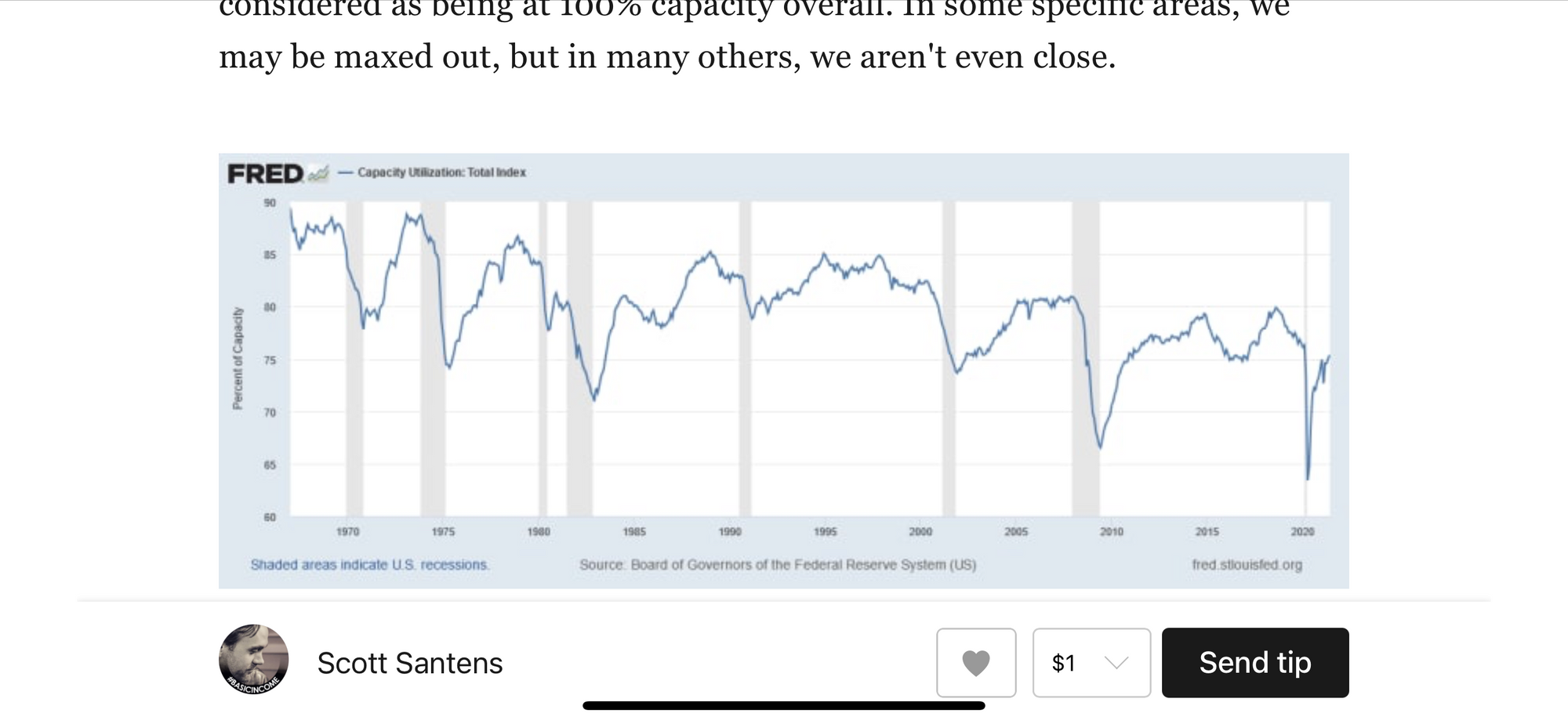

This article by Scott Santens has some good insights.

He refers to this chart, and here is his source:

Unlike the 1970s, there is plenty of spare capacity in the economy.

It is difficult to say for sure what the long term implications of the labour shortage will be as the baby boomers retire, but if the Japanese experience provides a lesson, it won’t be inflation.

And the late 1970s was a poor period for innovation. Today, thanks to the legacy of Moore’s Law, ever-faster internet speeds and a host of other technologies such as GPS and sensors/RFID devices, we see incredible innovations. Consequently, we are on the cusp of a period in which productivity growth will be extremely high, which in turn will mean any increases in wages we see will not be inflationary.

And if anything, remote working will have a deflationary effect.

That is what it is like when technology advances exponentially.

Investors are flying blind over ESG

And finally, something that does not follow an exponential path is regulation or governance.

Alas, it seems the auditing of ESG is not up to scratch. It's not easy and requires a whole new set of standards but it's arguably the only set of measurements we'll need in the next 50 years.

Hope you enjoy the newsletter, let us know by emailing info@techopian.com and if you really like it, send it to a friend you really care about.

Related News

The AI revolution is here

Jan 25, 2023

The impossible conclusion about technology becoming less disruptive and why it is so dangerous

Jan 20, 2023

Tech bubble! Are you kidding?

Jan 06, 2023