A benchmarking analysis of the German DAX 30 companies' sustainability reports reveals that none of them has a positive impact on society or `the environment. Some positive signs are visible, though.

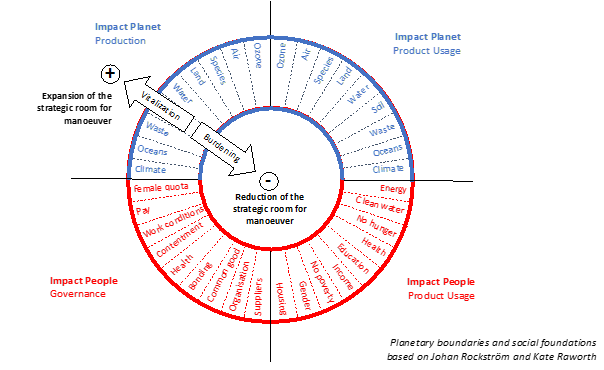

The association "The Future Circle e.V." analysed the sustainability reports of the DAX 30 (Germany's 30 largest companies) in 2019 and the first reports of 2020 from a new angle. Companies were assessed on several key performance indicators. The indicators covered the impact of these companies' activities, products, and solutions on the planet and people. A positive impact is defined as strengthening the vitality of the planet and people, whereas a negative impact implies burdening it. The graphic illustrates the scope of the assessment.

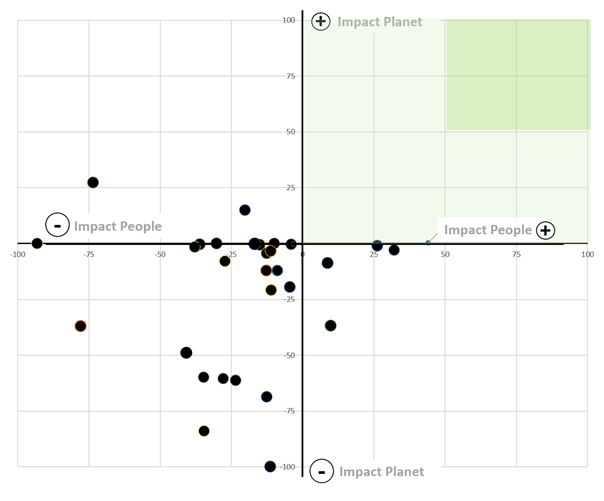

The benchmark for the 2019 status quo shows that all of the DAX companies are burdening, on people and planet. The DAX 30 has a way to go!

Note: As the intention is to illustrate the need for improvement (rather than 'blame and shame'), the results are anonymised.

The short story is:

Up to now, large companies have tended to pursue the legally or socially required minimum for the preservation of our environment and society (see Paris Climate Agreement with climate neutrality by 2050 and the law on equal participation of women in management positions). Genuine motivation, strategic re-direction and new ideas are largely missing. Generic statements about making production processes climate-neutral within the next 10-30 years is insufficient. The entire value chain up to the products' use and disposal need a clear roadmap towards - at least - "net-zero". Ideally, solutions need to revitalise the planet and stabilise society. However, some examples, e.g. from Covestro and Bayer, are encouraging.

In more detail, here are some key findings of the analysis:

1. Sustainability is more of a duty than a commitment:

The DAX companies are highly relevant for the environment and society. With around four million collective employees and €1.4 trillion revenue, these companies' products, services and investments (over €100 billion in investment funds, excluding financial institutions) have a major impact. In 2019, this impact was still predominantly negative. The 30 companies are responsible for emissions of approximately 1.3bn tons of CO2 equivalents (CO2e): 600m tons in their production and 700m tons through the use of their sold products until "end-of-life". Not all emissions have yet been recorded: As of today, only a few companies provide a complete product lifecycle reporting.

Positive social effects are also limited. On average, only around 25 per cent of managers are female, hence significantly below the target currently set by the German government with the draft legislation for equal participation of women and men in management positions in the private and public sectors.

Furthermore, there are wide differences in pay ratios. In 17 DAX companies, the Exec Board-to-average worker pay ratio is over 50-to-1. In three DAX companies, this ratio even exceeds 100-to-1.

2. Wrong focus of sustainability measures.

With regards to reducing their environmental impact, companies focus primarily on their internal product manufacturing processes. Their aim is to reduce harmful greenhouse gases in production. However, two-thirds of the harmful greenhouse gases arise during the use (and later the disposal) of the sold products by the customer. Even this figure is too low because only a few companies measure and report the impact of their products in the downstream value chain: Only 11 of the 30 DAX companies report on this – and then often only partially. Other impacts such as waste generation, air and soil pollution, water consumption, land-use, and threats to biodiversity from product use are not at all measured and reported.

If Deutsche Bank, with its size, were to achieve a similar impact as Triodos Bank, 300 million tons of CO2e could be saved

3. Few ambitions discernible:

An adjustment of business models has, so far, only happened in the energy sector. Government decisions to phase out nuclear and (later) fossil energy forced RWE and E.ON to make a U-turn away from fossil to renewable energy generation. Indeed, they had seen a profit collapse (- one per cent EBIT margin). Other sectors such as financials (15 per cent EBIT margin), chemicals/pharma (10 per cent), real estate (22 per cent), ICT (15 per cent), healthcare (14 per cent EBIT), and industrials (11 per cent) are still profitable. These companies are reluctant to jeopardise their profitability by changing existing business models. Meanwhile, the pressure to change is increasing on the automotive sector (six per cent EBIT margin) and individual participants from the financial sector such as Deutsche Bank (- two per cent EBIT margin). First signs can be seen at VW – with its electrification strategy – and at Deutsche Bank, where board member remuneration is now linked to sustainability targets.

4. Positive examples:

Role models for measuring the impact on the environment and society include sustainability banks such as Triodos (Netherlands) and GLS (Germany). They invest 100 per cent of their customers' money in sustainable projects and companies, generating a stable and long-term profits. Their annual reports go into detail about their company's overall positive impact on the environment and society. If Deutsche Bank, with its size, were to achieve a similar impact as Triodos Bank, 300 million tons of CO2e could be saved. This is equivalent to around half the CO2e emissions of all DAX companies' production activities.

5. Target setting in 2019:

In addition to the current measures to reduce environmental impact, some the DAX companies also report on their targets and ambitions. These are still formulated very inconsistently (in contrast to the profitability targets) and are still relatively modest: Of the 15 DAX companies with very high CO2 emissions, none state that it wants to achieve 'net-zero' along the entire supply chain by 2030. At least, Siemens and Bayer want to make their own production climate-neutral by 2030. The others have postponed their net-zero target to 2040 or 2050.

Almost all DAX companies formulate the goal of increasing the proportion of females in management positions. It should rise from an average of 24 per cent in 2019 to 30 per cent in the next two to five years. Then again, this goal is primarily driven by legislation. With the draft law "Second Leadership Position Act", the German government aims to achieve equal participation of women in leadership positions by the end of 2025. Accordingly, companies have adopted this deadline and target values. No-one aims at more ambitious goals.

6. Bold steps are the exception.

Deutsche Bank was the first company to integrate sustainability targets into the remuneration system for board members. Siemens and Linde have strengthened responsibility at the Director level with a "Chief Sustainability Officer" and emphasise the positive impact of electric drive and hydrogen for the environment.

7. "Greenwashing" still dominates in the 2019 sustainability reports.

The sustainability reports are documents that fulfil the basic legal requirements and provide a marketing tool to showcase sustainability initiatives. They typically list individual sustainability projects but do not show a consistent integration of sustainability into the corporate strategy, an ambitious purpose, an adaptation of the business model or a strong sustainability driven organisation. The sustainability position is currently primarily assigned to a board department (often CEO or HR director) and has more coordinating functions. Only two companies have created strong roles in the form of a CSO (Chief Sustainability Officer) at the director level.

Outlook

For the business year 2020, only a few sustainability reports are out yet, but a glimpse at those shows some promising signs. Two companies deserve mention:

Covestro, the manufacturer of industrial plastics, is significantly transforming its business model. It states that it will fully commit to a circular economy. CO2, biomass and waste will become alternative raw materials in production. The goals of the Circular Economy are integrated into the corporate strategy, and the transformation to a circular economy is governed through a global strategy program led by the CEO. All relevant corporate divisions and functions will be involved. The sustainability goals are integrated into the remuneration system of the board members and management.

Bayer, a healthcare and agrochemicals producer, sets concrete goals for its contributions to societal well-being in its sustainability report. Under the vision "Health for all, hunger for non," it states, for example, that, by 2030, it will provide developing countries with access to modern contraception for 100 million women and to support 100 million small farmers. There is a concrete roadmap for achieving these goals by 2030.

Remuneration of and the sustainability goals are integrated into the remuneration system of the board members and management. Bayer is the first DAX company to set out its goal (and the implementation plan) to positively impact the environment and society with (some) products and solutions. However, negative effects, such as the extinction of species due to pesticides, are not mentioned or quantified.

Another encouraging initiative is the 2019 launch of the "Value Balancing Alliance" association. The vision is to create a way of measuring and comparing the value of businesses' contributions to society, the economy, and the environment. Of the DAX companies, BASF, SAP and Deutsche Bank are founding members. Auditors Deloitte, KPMG and PwC, are also involved. A standard for measurement and reporting is to be developed within three years. A first methodology paper was published in March 2021.

About The Future Circle

The Future Circle e.V. is a global collaborative association that works in the service of humanity for an economy fit for grandchildren. We aim to inspire and empower companies and organisations and their decision-makers to establish and actively live sustainably successful business models with a positive impact on our planet and society for the benefit of future generations. The Future Circle supports companies in this process by taking on the role of educating, coaching and highlighting positive corporate examples. We are experienced managers, directors, consultants and scientists looking to engage in projects, events and publications for a new way of thinking.

Related News

Introducing The ESG Show Summit

Mar 05, 2025

Is AI really the solution?

Oct 25, 2024

ESG and the CEO

Jul 30, 2024