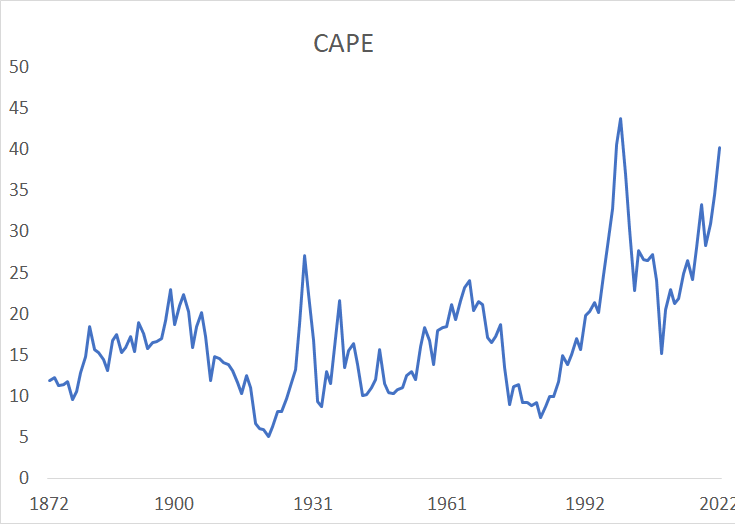

Beware the CAPE. The cyclically adjusted price-earnings ratio looks dangerously high. Are we getting close to a market crash?

This is the time of the year when people make predictions for the year ahead. Well, this is more a warning — beware the CAPE. The letters stand for the cyclically adjusted price-earnings ratio or CASE PE. The index compares the value of the US S&P 500 with earnings over the previous ten years. By factoring in earnings over such an extended time, the index is meant to provide a measure that sees through one-offs, creating a picture of the underlying situation.

Right now, there has only ever been one period since 1880 — which is as far back as the index goes — in which the CAPE was higher, and that was during the dotcom boom. The all-time high for the index was set at 44.19. The mean average for the index since 1880 is 16.90. The median is 15.86, and right now, the CAPE stands at 40.21. To put that in perspective, the CAPE was not so high in 1929 before the Wall Street Crash — when it was around 30 — in 1987 or in 2008.

Of course, the high level of the CAPE might be a sign of positive earnings ahead — it might also signify a market crash in waiting.

There is more than one reason for the high CAPE level — not all suggest reasons to fear.

- A partial explanation for high equity values is low-interest rates. Theoretically, when markets value a stock, they project future earnings and discount them by a given interest rate to derive a net current value. If interest rates are expected to be exceptionally low, then this discount rate is less, creating higher valuations. The worry here is that interest rates might have to go up sharply to reverse inflation. The thing to watch is real rates — the interest rate minus inflation. At the moment, the real rate is extraordinarily low; should this change, that may be bad news for share values. If inflation proves transitory, it is unlikely real rates will rise by much. On the other hand, if the inflation hawks are right, real rates may surge, possibly creating a market crash.

- Another partial explanation is that a handful of techs make up a high proportion of the S&P 500 and since techs typically trade at higher valuations to earnings (P/E ratios), an inevitable consequence of the S&P 500s shift to tech is a higher CAPE).

- Another explanation is that Covid negatively distorted earnings. So, the last 24 months has been especially poor for corporate earnings (excluding many techs). As a general rule, earnings rise over time. So the CAPE is usually disproportionately influenced by earnings over the previous two years. But on this occasion, rather than increase, for many companies, earnings have crashed. Thus the high value of the CAPE is simply down to the way averages work and actually not really anything to worry about. If earnings in 2022 turn out to be significantly higher than earnings in 2012, then that will put downward pressure on the CAPE. The index will only rise this year if stock market values rise faster than the extent to which earnings this year exceed earnings in 2012.

The above three points might suggest that the reasons behind the high CAPE are technical and thus nothing to worry about. This would indeed be a valid argument if the CAPE were merely quite high, but it isn't; it is close to passing a record.

Here is one prediction for you, if the CAPE passes the record this year, expect headlines.

And there is one other explanation for the high CAPE — markets have been inhumed with a certain degree of madness of crowds, of irrational exuberance. If that is right, expect trouble.

What would a market crash mean?

If the high level of the CAPE is indeed a sign of an imminent crash, what would such a stock market crash mean? Would it matter?

Post the crash of 1987; not much changed — creating a narrative that stock markets and the real world are not aligned.

But the 1929 crash was followed by the Great Depression, the 1987 crash did in fact lead to cuts in interest rates that fuelled a property boom (the Lawson boom) which crashed, and the 2000 crash was followed by lower rates which may have fuelled the forces which led to the 2008 banking crisis.

For technology and especially startups, a stock market crash would be disastrous. Investment sentiment is a funny thing; it tends to go through periods of extreme exuberance followed by periods of investors' extreme pessimism.

If there is a crash, it will become extremely difficult for startups to raise money,

Controversial view

Here is a controversial view for you to consider.

Maybe the problem isn't tech valuations; it is the high valuations of companies that are about to be disrupted.

Take Tesla — the company is currently valued at $1.15 trillion, close to its peak. Is this indicative of crazy valuations? Maybe it is but bear in mind that Tesla's annual vehicle deliveries increased from 32,000 in 2014 to 499,550 in 2020 and 936,172 in 2021. Tesla projects that 2022 will see 1.5 million deliveries. Toyota's highest ever level for car sales is nine million.

So Tesla still has a long way to go, but if its growth continues, Tesla could overtake Toyota for car sales later this decade. Bear in mind that Tesla cars have a much higher average price than Toyota's, its supply chain is more vertically integrated — it is not unreasonable to assume that as Tesla gains scale, its margins will exceed even Toyota's streamlined KAIZEN approach.

However, the real point here is that just two or three years ago, car industry experts said it was impossible for Tesla to reach the current level of scale in the short window of ridiculous benchmarks it set itself.

Tesla has confounded critics — to say its valuation illustrates why techs are so overvalued is to at least partially ignore its track record for consistently proving doubters wrong.

Then there is the Apple. Sure its P/E ratio is unusually high by this company's standards at the moment — but if its autonomous car and its move into augmented reality are as big deals as some technologists expect, the results could be extraordinary.

Autonomous cars could be one of the biggest disruptive shocks of all time. Tesla, Alphabet via Waymo, and Apple could be the primary beneficiaries; traditional car companies may fall like nine pins.

Or take banks — let's say cryptocurrencies remove the need for banks — imagine the shock that would represent for the stock market.

Then there are oil companies. Throughout the 20th-century, oil companies were among the biggest companies in the world. But will the pressures of climate change, renewables, and EVs turn oil into a massive stranded asset, spelling the demise of many of the world's largest oil companies as we know them today?

So yes, you could argue that stock markets are overvalued. Tech stocks may well see a crash at some point and then recover. But if you take into account the fourth industrial revolution, take into account the disruptive potential of some technologies, maybe it is many of the traditional companies that are truly overvalued and not tech stocks.

Let's see what the markets say, so far Jan 2022 is definitely not Jan 2021.

Related News

The AI revolution is here

Jan 25, 2023

The impossible conclusion about technology becoming less disruptive and why it is so dangerous

Jan 20, 2023

Tech bubble! Are you kidding?

Jan 06, 2023