Apple, the company that produces technology that makes it easier to work from home, is asking employees to return to the office; and staff are not happy.

A headline on Bloomberg got right to the point: it headlined: Apple makes it easy to work remotely (unless you work for Apple).

Some employees at Apple are fuming. At the moment, they are encouraged to go into the office one day a week, but by May 23rd, the company is saying employees must be in the office at least three days a week. (Maybe the phrase ‘at least’ is especially telling).

Some employees have banded together to form Apple Together. “At Apple, we make incredible products and services. We pour ourselves into that work, whether we are enriching customers’ lives at the Apple Store, animating rain for the next Keynote, plating lunch at Caffè Macs, or chatting with a customer to transfer their family videos from their iPhone to their MacBook,” states Apple Together.

But it adds: “In Slack, we have written letters together to make requests of our leadership. However, we’re seeing an increase in rules restricting our ability to continue collaborating on workplace issues that are important to us. So, we’re making our own space off of our virtual campus to ensure our voices can still be heard.”

Some staff have voted with their feet and left the company. For example, Ian Goodfellow, Apple’s director of machine learning, is quitting. He said: “I believe strongly that more flexibility would have been the best policy for my team.”

And this brings us to ESG

There is an S in there somewhere. Paul Clements Hunt, who co-created the ESG acronym, says that the S was put in the middle to stop it from falling off the side.

But contrary to what you might read elsewhere, ESG isn’t an anti-capitalist movement. Instead, it began life as a way to help investors run an investment strategy.

The S isn’t there in ESG to create a happy world and put profits on the back-burner; the implicit assumption behind ESG is that certain strategies lead to profitable growth in the long run. Maybe creating a happier workforce is one such strategy. In this sense, or so goes the theory, investors and workers are in a symbiotic relationship; when workers are happy, investors will become happy. Like a smiling employee is linked to investors, an invisible wire connecting the facial movement of staff to those of investors.

So, if staff are unhappy and, at a time of labour shortages, start handing in notice, then maybe the employer has a problem in the making.

And this is one of the rationales for remote working. Offer a remote package to staff and retain competitiveness in the labour market.

When even a company like Apple, which likes to suggest it has a halo shining above its corporate head, its saintliness there for all to see, is seeing disgruntled workers, you realise how important the issue is.

Greenwashing — remote washing

For Apple, there is a deeper issue. You can’t proclaim the credentials of your technology as a means to support remote working and then apply different standards to your staff.

So that’s authenticity. There is also the issue of disruptors getting disrupted.

Apple is the master disruptor, the company that created products which left the likes Blackberry, Nokia and Motorola with existential crises. The lesson of disruptive technology is to embrace change, re-think your existing ways, and plan for the future.

An open letter sent by Apple employees and ex-employees to the top brass at Apple says the company is “driven by fear….” Fear of the future of work, fear of worker autonomy, fear of losing control.”

Scream out the S

So, the Apple workforce is saying Apple is making the wrong decisions for Apple — that’s why the S matters; get the S right, and maybe in the future, the P&L will look better too.

The open letter states: “What is also required for creativity and excellent work for many of us is time for deep thought. But being in an office often does not enable this, especially not many of our newer offices, with their open floor plans, which make it hard to concentrate on anything for an extended amount of time.”

Getting hybrid working to work

The Apple hybrid plan involves staff coming into the office on Mondays, Tuesdays and Thursdays.

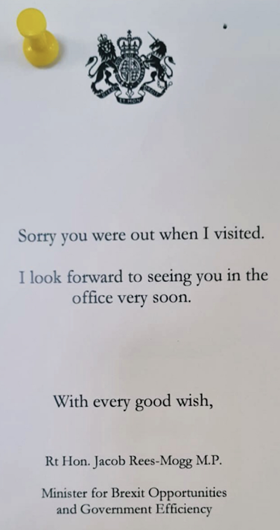

In the UK, we see a different argument; not so much hybrid versus fully remote, as full-office-based versus hybrid.

(Civil servants tell me that they already operate under a hybrid model — not dissimilar to the model Apple wants to enforce. However, the government seems to want them to ditch this in favour of a 100 per cent office-based model).

Getting it to work

Some important points regarding remote working are being overlooked.

What matters is not what Jacob Rees-Mogg or Tim Cook thinks; it is what the data says.

If the data says remote working creates efficiency, then do it. If the data says hybrid is more effective than fully remote, then do hybrid.

With Apple, one of the core issues was a collaboration with colleagues worldwide. If you work in Cupertino, California (the location of Apple’s head office), and you need to spend your days talking to colleagues in Europe and Asia, as well as the US east coast, then you need a kind of staggered working day; first thing in the morning for talking to colleagues in Europe, later at night communicating with colleagues in east Asia. So, working from an office doesn’t suit.

For other companies, the issues are different.

What we can say, without doubt, is that under a capitalist system, when you have two competitors with similar products, the one with lower overheads will have a strong advantage and in time, it will probably crowd out its competitors.

If it can be shown that remote or hybrid working does not lead to lower efficiency; then the company that realises this will, in time, move into smaller offices or apply a more flexible leasing arrangement— such as the ability to only pay for office space on say Mondays and Thursdays.

In this way, companies that can make remote or hybrid working effective will be at an advantage, furthermore, an advantage from which investors may want to benefit.

ESG and remote and hybrid working

And this takes us to ESG and, in particular, the bit in the middle.

Making remote or hybrid working successful needs time, effort and expertise.

For some employees, their job is the centre of their social life. For some employees, there is a fear that they will lose out on promotion opportunities by working from home.

With remote working, there is a risk that employers may lose touch with employees’ mental health.

Employees may become reluctant to call in sick when working remotely.

For the organisation, there is a risk that a remote workforce may lose a sense of identity with their employer.

For the employer, creating an effective remote/hybrid environment is not just important; it may be a matter of long-term survival.

It just shows: the S in ESG matters.

PS: Critics of remote work might say it is negative for the ecosystem — the local economy supporting offices. Since ESG is supposed to look at the broader issue of the effect of its policies on society, because society matters for the long term strength of the company, then maybe ESG should consider the wider implications of remote work. But then that smacks of fear of change — remote work might be negative for local economies in city centres, but it is doubtful it is negative for society in general.

Article originally appeared on GRC World Forums

Related News

Introducing The ESG Show Summit

Mar 05, 2025

Is AI really the solution?

Oct 25, 2024

ESG and the CEO

Jul 30, 2024