Contrarian investors take note, 2023 is the year to buy tech, and these five companies will be in the vanguard.

Hunan nature — it's a funny thing, and when you throw in group dynamics, it becomes stranger still. Right now, human nature, magnified by the investor crowd, says that 2023 will mark a return to more traditional solid investments like bonds and commodities; this is the year, or so goes that narrative, when tech will come crashing down to Earth, like a bowl of petunias.

But we have been here before, and I say this to those who forecast even more woe for techs "oh no, not again!"

Techs will boom this decade and next, and either 2023 or maybe 2024 will mark the beginning, just as techs boomed in the two decades following the dot-com crash.

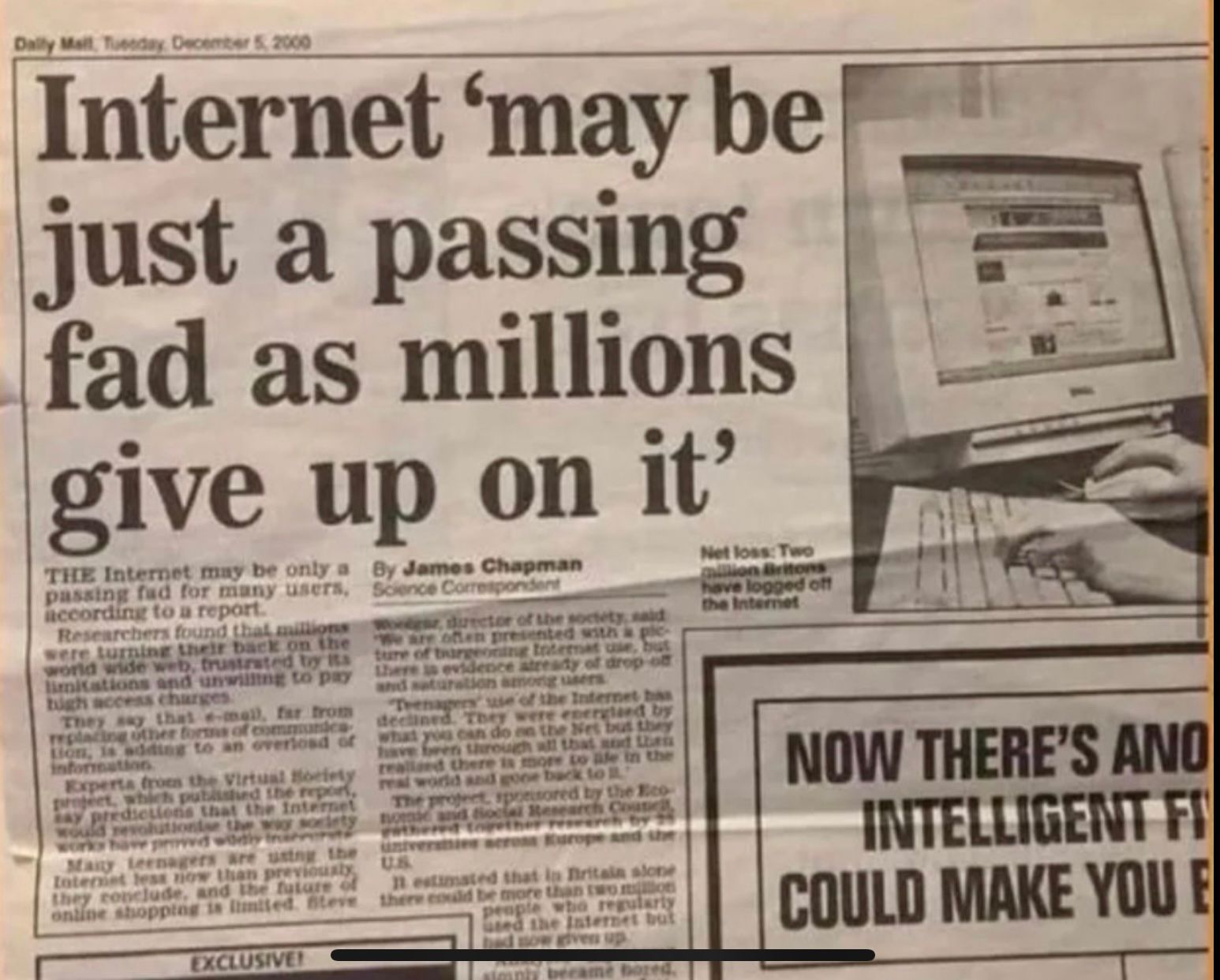

Yet, when dot-coms crashed, wise heads scratched their heads at the folly of tech investors, "I told you so," they said. Indeed in December 2020, the Daily Mail ran a piece suggesting the "Internet 'may be just a passing fad as millions give up on it.'"

Techopian can exclusively reveal that the Internet didn't become a passing fad, and hundreds of millions did the very opposite of giving up on it, and in the process, we saw a quartet of techs help form the list of the five most valuable companies of all time — with just one old school business, Aramco, also in the group.

Expect history to repeat itself, but substitute the phrase 'internet boom' for the phrase 'AI boom. '

Time to buy

They say that the time to sell is when the most bearish of investors turn bullish, and the time to buy is when the most bullish of investors turn bearish.

And according to the above terms, the time to buy techs is now.

The AI revolution

There is another reason to buy techs — the AI revolution is moving up a gear.

Sure, most of us used AI in 2022 without even realising it, like navigating using a map app, for example. But the tail end of 2022 saw the release of ChatGPT from OpenAI. It is difficult to draw a precise historical analogy between this release and previous moments in the story of tech. It is tempting to draw a parallel with the launch of the iPhone in 2007 — but if that analogy is correct, then OpenAI is like Apple, and Alphabet is like Nokia. But that isn't quite right because Alphabet owns DeepMind, and last year, it felt as if DeepMind was turning heads every few days with one wonder announcement after another.

ChatGPT marks a significant moment but is currently too server intensive to power search. Alphabet's big wigs, after observing ChatGPT, have already started talking about code red. Will OpenAI or AI tools from the likes of Stability disrupt Google? It seems unlikely; for one thing, DeepMind is probably the leading AI company in the world. A study of disruptive technology shows it takes a paradigm shift to significantly dent the position of market leaders — such as a shift to touchscreen smartphones or from internal combustion engine to EVs. By contrast, incremental, evolutionary-type change tends not to upset an industry's hierarchy. ChatGPT may mark an incremental step, but given Alphabet's deep expertise in AI, it may not even mark that much of a step and probably not enough to overcome Alphabet's network-effect advantages.

But whilst ChatGPT probably won't shake Alphabet's market dominance in search, it does illustrate how AI is beginning to have a wider impact. For example, reports are circulating of individuals using ChatGPT to help them with their coding or writing a report.

2023 will see the release of GPT4, and it will probably see multiple major announcements from DeepMind. AI is entering a new phase. The behind-the-scenes research phase is giving way to the high-profile product-launches phase. AI will change the world, and 2023 marks the year when this will begin to become obvious.

The renewable revolution

Of course, the remainder of this decade will see a boom in renewables— only those who have been living on Mars, the most died in the wool climate change cynics, and those who are either consciously or unconsciously influenced by anti-climate change and renewables propaganda can deny this.

But less obvious will be the role of AI in underpinning the renewable revolution as smart-charging and smart-grid-pricing, which oscillates with wind and sunshine, enable a more intelligent way of matching energy demand and supply.

The vacuum

Claims that the technology stock market boom is over are made in a vacuum that ignores the lesson of the dot-com crash and the extraordinary advances in AI.

Those who predict a commodity boom are only right when discussing commodities which will underpin the AI and renewables revolutions — copper will surely be the metal of the decade; lithium will do well, although don't expect the price to go that crazy, instead expect many more lithium mines to open. Ditto for rare Earth minerals.

But certain companies are beautifully positioned to benefit from the AI revolution.

The technology quartet and the fifth element

And I see a quartet of techs, maybe a quintet, as the likely beneficiaries of the AI and wider technology revolution

Heading this list is Alphabet, my tip for the largest company in the world in 2030.

But don't write off Apple; big things will likely be forthcoming from Apple in 2023 and 2024.

Those who say Apple has lost its touch in innovation misunderstand the underlying forces that make possible paradigm shifts like touchscreen smartphones. The iPhone's success lies partly with advances in non-Apple technologies such as evolving screen display technology, evolving wireless internet access, commoditisation of components and Moore's Law. The Techopian believes that the next paradigm shift in smartphones will be when touchscreen keyboards are replaced by virtual keyboards, which we view via glasses or contact lenses. When this paradigm shift occurs, the opportunity to disrupt Apple will emerge. And yet, unlike pre-iPhone Nokia, Apple understands the threat and is likely to be a pioneer. A moment of danger for Apple approaches, but it is way too soon to write the company off, and Apple may well be be a pioneer in this field. Watch Apple in 2023 and 2024 for evidence to support this proposition.

Microsoft, which under the leadership of Satya Nedalla has vastly exceeded expectations, is likely the third member of this quartet - bear in mind that it is an investor in OpenAI. It is embracing the AI revolution, and its forays into augmented reality with products like HoloLens illustrate how it is likely to remain in the vanguard of the technology revolution.

I have my doubts about Amazon — I am not writing it off, but do think online retail will go through major upheavals this decade as we see the rise of local smart warehouses and a surrounding ecosystem of stores supported by augmented reality. These upheavals could represent a paradigm shift in retail, and I am not convinced Amazon will retain its position of strength.

The Techopian tip for the fourth member of the quartet is another AI company — although this company is also an energy storage company and has a foothold in solar too. It also has another product; what is it now? Oh yes, it makes cars too. I refer to the company that critics love to critique and which saw its share price fall by more than two-thirds last year. But critics don't get what makes this AI company which also happens to sell cars, so exciting. To illustrate my point, consider Volkswagen, which fired its CEO last year because of problems with software. The company I refer to is several years ahead of all rivals in both software and AI.

I refer, of course, to Tesla. Even Tesla bulls are getting nervous; that is a reason to at least consider it as a stock set to boom. But, for me, its speciality in AI makes it a slam dunk.

See: Tesla isn't a car company

The only car company that may not be too far behind is GM, thanks to its autonomous business Cruise.

AI will transform the automobile industry and underpin a convergence with energy companies with vehicle-to-grid technology. Tesla is perfectly poised, with network effects — with control over EV charging points, for example.

I have doubts about Elon Musk — he has proven himself to be a visionary but a high-stakes gambler. Not sure he is the right person to preside over the next chapter in Tesla's story.

The AI revolution will also require hardware. I am not 100 per cent on the company I am about to mention, which may be pinning too much on the end of Moore's Law when the next paradigm shift, perhaps involving quantum computers or photonics, could create a new Moore's Law. So keep my new Moore's Law caveat in mind when I say the fifth element is probably Nvidia — a company with the chipsets to underpin the AI revolution supporting the deep-learning evolution.

See Photonics breakthrough could lead to a 20-fold increase in processing

The time to buy tech is 2023 or possibly 2024. (It is impossible to predict the perfect timing, techs may fall this year, but the long-term trend will be up.) My quintet are the companies that are likely to dominate/continue to dominate.

There may well be other players — maybe OpenAI will be one of them, but it is too soon to say.

Related News

Tesla — has the bubble burst, or is it still a disruptor?

Jan 10, 2023

Tech bubble! Are you kidding?

Jan 06, 2023